As a farm boy, Clay Murdoch instinctively knows what to do when dew forms on cut hay in fields. As chief executive of Doug Andrus Distributing, he also knows what needs to be done in a hot freight market.

“We need to bail hay,” said Murdoch on Monday, Oct. 1, during a breakout session at the McLeod Software user conference in Birmingham, Ala.

Doug Andrus is busy cleaning up the freight and rates in its network. On the morning of Oct. 1, for instance, a shipper contacted the company to ask for trucks in the fourth quarter of 2018, he said.

Last January a salesperson had asked the same shipper for a rate increase. “They laughed at us,” he said. “Who’s laughing now?”

In his 30-year career in trucking, Murdoch has never seen a freight market like this for Doug Andrus Distributing, a 270-truck carrier based in Idaho Falls, Idaho.

Lamar Quinn, general manager for R.E. Garrison, also has never seen market conditions so ripe in his 35-year career. The Vinemont, Ala.-based truckload carrier is taking advantage of the opportunities to redesign its freight network, he said.

R.E. Garrison has shortened its length of haul to 494 miles, on average, to maximize utilization and get its drivers home regularly. Quinn expects the rate environment will be even better during the fourth quarter.

“Oh my, baking season’s coming baby,” he said at the same breakout session.

Chasing opportunity

On the morning of Oct. 1, Tom McLeod, founder and president of McLeod Software, advised more than 1,200 attendees at the company’s annual user conference to “decide where the opportunities are and turn down bad freight,” and to “go after the customers you’ve always wanted.”

Clay Murdoch, chief executive of Doug Andrus Distributing, said he has never seen better market conditions in his 30-year trucking career.

Data from the American Trucking Associations show the number of loads increased 15 percent from 2010 to 2018 and carrier revenues went up by an even greater margin. ATA forecasts that freight volumes will increase between 27 and 40 percent by 2029.

“Everyone has all the freight they can handle. What do you do with that fact?” McLeod asked. “You have the power to transform your company.”

Third-party logistics and freight brokerage companies are faring very well too, he noted, as shippers are struggling to find capacity beyond their core carriers.

McLeod Software, based in Birmingham, offers enterprise-wide transportation management software (TMS) for motor carriers, brokerage and logistics companies.

“Doing everything with one product gives us a lot of leverage to develop features we can apply across the full product line,” he said.

During the keynote address, McLeod described new tools and product integrations for its users to maximize opportunities in the current environment.

“Our aim is to put you in middle of the universe to connect to all products and services,” he told the attendees, saying they would be “more efficient and be able to take advantage of your particular niche in the marketplace better than your competition.”

Digital freight matching

New product announcements during the annual McLeod Software event centered on increasing freight visibility, connectivity and profitability for the non-asset 3PL and freight brokerage clients that use its PowerBroker transportation management system (TMS) and for the carriers using its LoadMaster TMS platform.

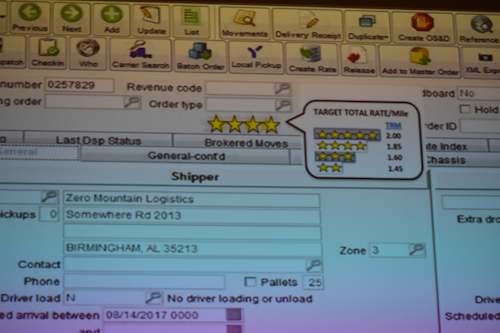

McLeod Software is developing a 5-star rating system for loads using data science.

PowerBroker has new tools such as an Integrated Carrier Search function that can instantly match and share available loads with carriers based on their lane preferences, historical data, and real-time locations.

Freight brokers and carriers using McLeod TMS products can use a built-in McLeod Exchange feature to share visibility of available loads and capacity.

The Exchange platform has been part of its base TMS products for five years. The number of freight matching users has reached the point of critical mass, and “we are starting to see adoption taking off,” he said.

With the McLeod Exchange product, carriers and brokers are able to view current market rates and market density (in terms inbound loads) to facilitate rate negotiations.

“We’ve got a lot of checks on data for validation,” he says.

For brokers, the rate information is split into billed rate and paid rate to carriers to show the average margins in lanes. Broker margins typically hover around 15 percent, McLeod said.

Another new tool for carriers and brokers is the McLeod Anywhere Carrier Mobile App. The tool can be downloaded to driver phones to automatically capture load tracking data while giving drivers functions to capture proof-of-delivery documents, post available tractors, accept load offers, message dispatch and more.

Bringing in data science

A predictive scoring system for loads is currently being developed for the LoadMaster platform. The system will give carriers a simple way to evaluate the “forward profitability,” or yield, of their orders.

McLeod partnered with a data science company to develop the scoring system, which uses a 5-star rating for each load. Visually, the rating system is similar to what Amazon uses for online shoppers to evaluate products.

When a load comes in, users can immediately see the rating and determine what they need to do, in terms of load planning or rate negotiations, to increase the score, explained Randy Seals, customer advocate at McLeod Software.

Randy Seals, customer advocate for McLeod Software, discussed a new 5-star rating system for loads.

The score is a “forward yield” calculation of (revenue – cost)/time. The scoring uses historical lane data to calculate where a truck will likely be coming from to pick up the load and the next four moves a truck will likely be making.

“It will define your network for you, and you may find out your network is not what you think it is,” Seals said.

Other load planning features are under development. LoadMaster Trip Planning builds on the Driver Feasibility functions in LoadMaster to give carriers new tools to plan details of trips with the driver’s input, and then manage those trips in transit.

The trip planning tool will incorporate historical and live traffic data, weather, hours of service and parking availability on the route, the company says. Drivers will have visibility to the trip planning information through the McLeod Anywhere app.

During the conference, McLeod also addressed the future of blockchain technology. McLeod Software was one of the founding members of the Blockchain in Transport Alliance (BiTA), which is working to develop industry standards for blockchain transactions.

McLeod read from a letter that Walmart had recently sent to its food suppliers. The letter informed them of a new blockchain initiative to trace all leafy green foods back to farms. Its suppliers have until September 30, 2019, to fully comply with the blockchain initiative.

“We are going to be learning and moving on your behalf because you are going to need to be ready for blockchain,” he said. “It applies to Walmart suppliers at this point, but carriers will have to be involved at some point.”

Original Source: https://www.ccjdigital.com/mcleod-software-taking-brokers-carriers-deeper-into-freight-matching/