Electronic data interchange (EDI) is engrained in the transportation industry.

“Every time someone comes up with the killer idea that is going to kill or replace EDI, it never has. EDI continues to survive and thrive,” says Ken Craig, vice president of special projects for McLeod Software.

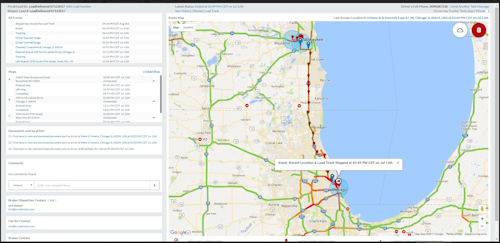

Photo credit: Load Delivered

EDI protocols enable shippers, carriers and third party logistics (3pl) companies to exchange load tenders, shipment status updates, invoices and other routine communications.

Some shortcomings of EDI have been apparent for some time, however.

One shortcoming is that EDI transactions are typically sent and received in batches. This causes a delay in transmission that gives carriers a chance to review and edit data before sending. This may cause trust issues.

With newer technologies, parties are sharing data in near real time to eliminate chances for editing.

“The new thing is the immediate tracking of shipments in five to 10-minute intervals,” says Jerry Robertson, chief technology officer of BOLT System, a cloud-based dispatch and transportation management system for commercial and private fleets.

The technology that is challenging or replacing EDI offers more robust communications as well.

Shippers are “looking for far more data, and more accurate data than they had before,” he explains. Carriers are getting requests to provide visibility of individual product SKUs in transit and accurate ETAs that factor driver hours of service, traffic and weather conditions.

“That is the kind of data that people want to evolve to,” Robertson adds.

Intelek Technologies, a company that provides EDI and data translation services for clients in transportation has seen non-EDI forms of communications growing to meet the e-commerce demands of shippers.

The Load Track platform from Trucker Tools captures near real-time shipment locations using the GPS on drivers’ phones.

“You can reach in your pocket and pull out a phone to find out information about anything in the world,” says Terry Wood, vice president of business development. “That is the same type of information access and requirements the transportation industry is faced with.”

Application programming interfaces (APIs) and extensible markup language (XML) are protocols that have been replacing or supplementing EDI transactions for some time. Now, they are about to take a backseat to Blockchain technology, which experts say can expand the visibility and security of freight transactions like never before.

Freight Visibility

Tim Leonard became familiar with EDI while working at a major truckload carrier. For a system that was supposed to automate freight transactions, he remembers EDI involving a lot of human touches, intervention and editing of data.

As chief information officer at TMW Systems, one of the largest transportation management software developers, Leonard has seen non-EDI forms of communication overcome the inherent trust issues of EDI.

“Technology is evolving around getting two marriages together and having that trust of what (data) is being delivered and when,” he says. “The technology we are seeing today is not any faster or quicker than EDI, but it enables the faith and trust.”

Freight visibility companies, for example, have been growing rapidly. They use APIs and other protocols to exchange track-and-trace data from carriers with 3pls and shippers.

MacroPoint, FourKites, 10-4 Systems and Trucker Tools are some of the companies that fit this mold by capturing tracking data directly from the source — from apps on drivers’ smartphones, from software integrations (APIs) with carriers’ electronic logging devices and from fleet management systems.

One of the reasons their platforms are popular is they expand the universe of automated shipment tracking. Small carriers have traditionally not had EDI communications, and these platforms bring visibility to this segment of the market which for many shippers is 20 percent of their capacity, says Robert Brothers, manager of product development at McLeod Software.

McLeod provides EDI translation services to carriers and 3pls that use its transportation management software (TMS). The cost and labor to map EDI transactions for carriers and 3pls is really no different than integrating freight visibility platforms with its TMS systems using newer protocol like APIs, he says.

C.H. Robinson has an ELD partnership with One20 to offer discounts for its carriers and integrate shipment tracking information.

Some shippers and 3pls are bypassing freight visibility platforms by capturing data directly from carriers. C.H. Robinson, one of the largest 3pls, has partnerships with ELD providers to obtain shipment tracking data from carriers that it books on loads, says Kevin Abbott, vice president of North American truckload services.

The company uses API integrations to automatically request tracking information from the ELD system a carrier uses when the carrier is booked on a load. The APIs request tracking information for the appointed time windows of pickup through delivery, he says.

The servers of the ELD provider follow the API requests and send tracking updates to C.H. Robinson’s transportation management system, Navisphere, which then translates the information into electronic data interchange (EDI) messages (214s) sent to shipper customers.

In some cases the company uses direct API integrations with its shipper customers to provide shipment status updates, he says.

Through its ELD partnerships, C.H. Robinson is offering discounts to thousands of carriers it does business with. For carriers that do not presently have ELDs, C.H. Robinson collects shipment information using its NaviSphere smartphone apps, Abbott says. The ELD integrations are preferred since they require no driver interaction to start and stop the tracking.

To reward carriers for participating in these automated systems, C.H. Robinson plans to offer earlier access to higher-paying loads that require frequent tracking updates. The company can also monitor the loading and unloading times and give carriers the first choice of loads that have faster turnaround times.

“We want to make sure there is value being sent back as a result of sending track and trace information,” he says.

Original Source: https://www.ccjdigital.com/beyond-edi-part-1-carriers-open-the-kimono-to-shippers-brokers/