In the not-so-distant future, matching loads with trucks could be as easy as catching a ride across town with the Uber app. In fact, Uber Freight is among a number of technology companies trying to digitize the entire load matching process.

For most transportation companies, however, the road to automation is a work in progress. A sign of this road construction in offices across the country is side-by-side computer monitors that display applications from multiple systems to the users who match freight.

Increasingly, the freight matching process is evolving to take place with single platforms that connect shippers, brokers and carriers to share pricing, loads and assets with greater speed and visibility.

Speed to market

The freight matching process starts with pricing before turning quickly to securing loads and capacity.

ShipEX, a Salt Lake City-based truckload carrier and logistics provider, transports dry and temperature-sensitive freight. The company’s brokerage operation, ShipEX Logistics, also has a Last Mile division that specializes in “hotshot” loads.

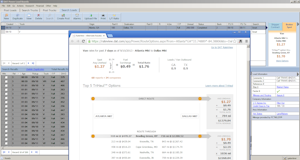

When ShipEX Logistics gets a new business opportunity from a customer or prospect, a salesperson uses the DAT RateView web portal to analyze historical rate trends for specific lanes.

DAT RateView shows the load-to-truck ratio in the origin and destination markets of shipping lanes. With these insights the salesperson settles on rates for spot market and contract bids.

A sales manager for ShipEX Logistics reviews lane pricing data from DAT and Truckstop.com

ShipEX Logistics assigns carrier reps to its core carriers. The reps are expected to have daily contact with carriers to identify where they have trucks available and to offer loads to keep their assets and drivers moving.

To expedite this freight matching process, ShipEX uses a cloud-based Aljex transportation management system that has integrations with online freight marketplaces or “load boards” from DAT and Truckstop.com.

A right click on any load in the Aljex system sends load details to ShipEX’s internal load board. This gives core carriers the first opportunity to bid on the load as the company simultaneously goes through search results from DAT and truckstop.com.

To prevent duplicate efforts, carriers listed in Truckstop.com’s search results turn red if someone has already contacted them. Similarly, when using DAT, office staff can add notes to update the status of communications with carriers in the search.

The carriers bidding on loads are highlighted in the Aljex system. The carrier with the lowest bid “is probably the one we are going to choose,” says Isaac Mendoza, vice president of ShipEX’s Last Mile division.

Location resistance

A number of applications use historical and real-time locations to give freight brokers visibility of available trucks. Motor carriers may be hesitant to share their actual locations unless it is for shipment tracking, however.

When using a load board, it’s common practice for carriers to post availability of trucks in an area to get a jumpstart on finding a load, even if the truck is hours or days away.

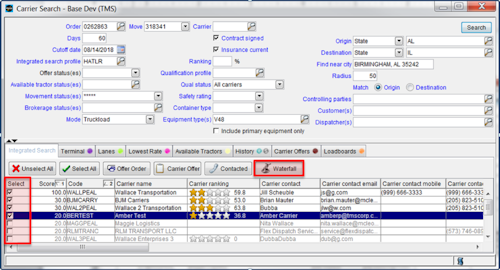

The Waterfall Tendering module from McLeod Software helps to speed the freight matching process between brokers and carriers.

“(Carriers) don’t want you knowing where they are,” says Brent Hutto, chief relationship officer of Truckstop.com, one of the largest online freight matching services.

At present, Truckstop.com does not use real-time locations for search results. That could change starting with the next generation of its load board. One feature that is already in the works, scheduled to appear in the second quarter, is “predictive freight suggestions,” Hutto says.

Predictive freight suggestions will give carriers and brokers the option to use a “Buy It Now” process. Brokers can choose to forego rate negotiations and offer repeatable loads to pre-qualified carriers at market rates. If carriers accept the offer, the loads can be sent electronically to carriers.

At a recent user conference, DAT announced efforts to create systems intelligent enough to know the location of the truck and the availability of the driver. Carriers who opt to share this information would benefit from more relevant load options, the company says. The load options would factor in preferred vendor relationships, competitive market rates, and desired routes.

Using data science

Location is one of many data points that can expedite freight matching. One of the largest 3pls, C.H. Robinson, has a team of data scientists that are using the company’s massive shipment database to build “tours” for preferred carriers.

Building tours is a recent development made possible by gaining a better understanding of patterns in shipping lanes.

Bruce Johnson, director of capacity development at C.H. Robinson.

“We used to be thinking load by load,” says Bruce Johnson, director of capacity development at C.H. Robinson. “A carrier would call and say ‘I need to get a driver home to New York.’ We would look for New York loads and try and get one close.”

By analyzing its customer and shipment data, the data scientists can identify when shipments will be available in certain lanes on given days to offer to carriers, several weeks in advance.

“Rather than looking to get a carrier’s truck close to New York, maybe our data is telling us we have a shipment that is available from Minnesota to Detroit, and then Detroit to Charlotte, where we know we always have a shipment from Charlotte to New York,” Johnson explains.

C.H. Robinson is also looking at shipper behaviors to identify which locations have high dwell times and other factors that influence load selection for carriers. The company uses a survey tool to give carriers the opportunity to rate shipping and receiving locations.

By identifying premium loads and locations in its network, “we can match them up with some of the carriers we have the strongest relationship with,” he says. “As we continue to get closer with carriers, they are certainly able to experience a difference from the traditional brokerage model.”

Instant connections

A number of software platforms are connected with shippers, brokers and carriers as part of a private freight exchange for matching freight with carriers based on real-time locations.

A large portion of loads that ShipEX Logistics moves through its Last Mile division are “hot shot” loads transported by non-CDL drivers to commercial and residential addresses, Mendoza says.

The Last Mile division uses the Xcelerator dispatch platform from Key Software. This platform includes a mobile app that uses the GPS of driver smartphones to provide automatic load tracking and status updates for arrivals and departures.

Xcelerator doubles as a private load board. The platform shows capacity that is available from carriers using the same system. ShipEX can locate capacity based on the current locations of carrier assets.

The Trucker Tools mobile app has been downloaded by more than 550,000 drivers and capacity owners. Besides trip-planning features, the software comes with a load tracking and predictive freight matching application called Smart Capacity.

Smart Capacity connects fleets that use the mobile app and cloud-based software platform to freight brokers, who can proactively offer loads to carriers in their private networks using locations and market preferences of carriers, explains Prasad Gollapalli, chief executive of Trucker Tools.

Using historical shipment tracking data, “we have seen where drivers are driving and we use that as market data,” Gollapalli says.

RateView from DAT shows revenue on a round-trip basis, including a Tri-Haul option.

Brokers that use Smart Capacity can see trucks from carriers in their private networks that will be available for loads several days in advance of arriving. If a broker does not have a load to offer the truck at its destination, the truck will be made visible to other brokers who use Smart Capacity a few hours before the truck arrives, he says.

The average size of carriers that use Smart Capacity is 10 trucks, he says. On a daily basis, at present about 100,000 loads are visible to carriers through the platform who are making about 115,000 trucks available.

In addition to using location data from the mobile app, Smart Capacity has natural language processing tools and artificial intelligence software that automatically reads and analyzes emails from carriers advertising where and when they will have trucks available.

Brokers can initiate this process by setting up an “auto-forward” rule redirecting carrier emails to Trucker Tools for real-time analysis.

A single platform

The majority of freight transactions between brokers and carriers are repeat business with companies they already have relationships with. Several new developments in digital freight matching technology focus on speeding communications with trusted business partners.

McLeod Software has focused many of its latest developments on digital freight matching, both for its asset and non-asset TMS systems used by carriers and freight brokers.

Waterfall Tendering is a new module for 3pls that use the company’s PowerBroker software system. With the tool, users can establish a scoring system for carriers they will use to automatically match freight.

Tom McLeod, president and founder of McLeod Software, discussed new connectivity tools for carriers and brokers at the company’s 2018 user conference.

The module searches the carrier database to find companies that have run the same or similar loads for the broker in the past. For carriers that meet the qualifications, the module offers the load electronically starting with the top-ranked carrier in the system. If the first-choice carrier does not respond to the offer in 20 minutes, for example, the system moves to the next carrier on the list and offers the load, says Dustin Strickland, manager of McLeod’s PowerBroker and LoadMaster products.

Another recent development by McLeod is Capacity Creator. The tool automatically reads emails received from carriers and uses historical load data from the PowerBroker system to enter trucks into the system that are available for matching with loads, he explains.

A cloud-based TMS from Kuebix is utilized by more than 18,000 shippers, brokers and freight forwarders to integrate directly with the TMS software used by truckload and less-than-truckload carriers.

Through the integration, Kuebix retrieves contract and spot-market rates from carriers, and electronically tenders them loads and tracks shipments for shippers.

About 80 percent of the loads that move through the system are for contracted bids. The remaining 20 percent are spot market transactions, says Dan Clark, the company’s founder and chief executive.

Kuebix has an integrated load matching service called FleetMAX for spot market freight. The service is managed through a partnership with Estes Express, the largest private LTL carrier in the United States.

Shippers and brokers that use the platform can expose freight to capacity providers in FleetMAX to find trucks using actual locations and hours of service data, he says. Estes Express manages the relationships with carriers and freight payments.

Compared to a load board where carriers get multiple calls from different brokers when posting an available truck, carriers deal with one entity — Estes Express — for load matching, he says.

Freight brokers also use FleetMAX to post loads. With Estes in the middle using the Kuebix platform, the broker is invoiced for the load without having to worry about another broker or carrier back-soliciting loads from its shipper customers, he says.

“Brokers feel comfortable giving a load to a fleet (Estes) as opposed to another broker,” he says.

While there are many options for freight matching technology, the trend is towards greater connectivity and integrations that enable transportation companies to do more from one platform and a single screen.

Original Source: https://www.ccjdigital.com/the-digital-edge-brokers-carriers-ramp-up-freight-matching-tools/