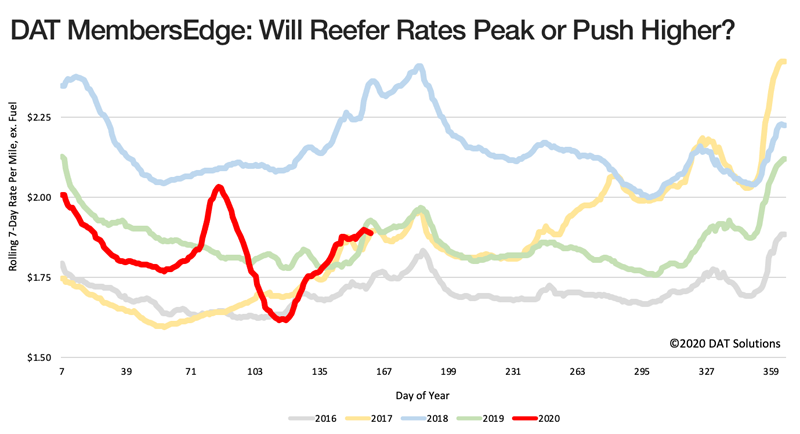

Spot truckload rates are inching back to where they were at this time in 2019, according to rate data from last week. That is no small feat considering the pit they fell into in late March.

National average van, reefer, and flatbed rates last week on DAT MembersEdge rose in response to an 18% increase in the number of loads posted during the week ending June 7. Truck postings rebounded 13% compared to the previous week as capacity shifts to the spot market to take advantage of the increased activity.

National average spot rates through June 7

- Van: $1.75 per mile, 15 cents higher than the May average.

- Flatbed: $2.01 per mile, compared to $1.90 in May.

- Reefer: $2.10 per mile, versus $2.02 in May.

Those are rolling averages for the month of June. On June 1, the van spot rate averaged $1.72 a mile, the flatbed rate was $1.98, and the reefer rate was $2.08.

Trends

Produce stand

The national average reefer load-to-truck ratio was 3.9 last week, up from 3.7 the previous week. Spot rates increased on 40 of DAT’s top 72 reefer lanes by volume. The number of loads moved on those lanes declined 3%, an indicator worth watching considering that June is a peak month for reefer freight.

Lake effects

Warmer weather is driving demand for reefer equipment in the Great Lakes region. Outbound rates from Chicago averaged $2.18 a mile last week, up 12 cents week over week, and Grand Rapids, Mich., to Philadelphia, rose 25 cents to $2.86 per mile.

Florida falling

Spot rates fell on 16 of the country’s busiest reefer lanes last week, and the top seven decliners originated in Miami or Lakeland, Fla. Lakeland to Baltimore fell 17 cents to $2.03 compared to the previous week, while Miami to Atlanta paid 16 cents less at $1.52 per mile.

Flatbed ratio hits a milestone

Load volumes increased 2.2% on the top 78 flatbed lanes last week, and the national average flatbed load-to-truck ratio poked above 21 last week. Last June the average was 20 loads per truck, the high-water mark for 2019.

Load volume from Houston, the country’s busiest flatbed freight market, was up 2.6%. However, the average outbound rate gave up a penny to $1.95 a mile.

Van volumes on the rise

Spot rates were higher on 72 of DAT’s top 100 van lanes by volume last week compared to the previous week, and the number of loads moved on those 100 lanes was up by an average of 28%. The national average van load-to-truck ratio dipped from 2.8 to 2.7, however, as capacity arrived on the spot market.

Major markets respond

Load volumes out of virtually every major van market increased by double-digit percentages. That was especially true last week out of Los Angeles and Chicago:

- Los Angeles van load volume increased 21% compared to the previous week and the average outbound rate climbed 9 cents to $2.41 a mile.

- Chicago van load volume was up 35% and the average outbound rate added 11 cents to $1.89 per mile.

This summary’s month-to-date national average rates were generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $68 billion in freight payments. Actual spot rates are negotiated between the carrier and the broker.

For the latest spot market updates related to COVID-19, visit DAT.com/industry-trends/covid-19 and follow @LoadBoards on Twitter. You can post comments on the DAT Freight Talk blog or on the DAT Facebook page. You can listen to the DAT MembersEdge report every Wednesday on Land Line Now.

Original Source: https://landline.media/spot-rates-catching-up-to-higher-volumes/