The “Uberization” of freight has been a topic of some discussion following the rise of the Uber taxi service. If you’re not familiar with it, Uber allows a customer to click within a smartphone app and, usually within a few minutes, an independent contractor arrives in his or her car. Prices are standardized and in part demand-based, and automatically charged to the user’s credit card, usually at noticeably lower rates than traditional taxis.

Mainstream media use the “sharing economy” phrase to describe such phenomena where startups enabled by mobile communications technology disrupt not only the traditional cab business but also the hotel and small parcel delivery industries, among others.

In the latter category, Roadie.com made news last month with its partnership with Waffle House restaurants as meeting locations for its drivers and shippers/receivers. “Waffle House angling to replace the Post Office,” crowed Newsweek magazine, detailing Roadie’s “direct competition with traditional delivery services like FedEx and UPS.

Local LTL hauler Victoriano Molina has three trucks dedicated to Cargomatic’s on-demand brokerage platform.

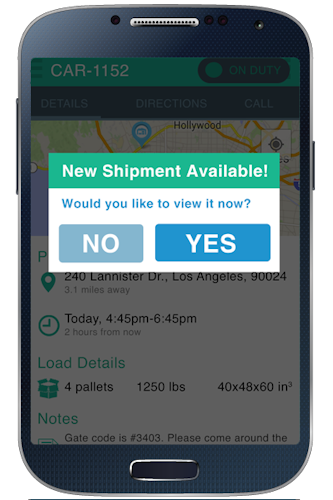

The program’s app enables shippers to connect with available drivers seamlessly. GPS functionality on the phone enables in-transit visibility for shipper and receiver. In-phone cameras serve as proof of pickup and delivery. Standardized rates translate to quick payment upon delivery.

In the truckload market, new players are lining up to be the “Uber of trucking.” Whether any – or none – will reach the scope of the taxi service, becoming a true disruption in an industry in which the independent owner-operator and smartphone-based load-matching technology already are fairly prominent, is anybody’s guess. In less-than-truckload operations, elements of the so-called “sharing economy” have been on the rise for years.

Victoriano Molina’s California Less-than-trailer-load business runs eight 26-foot box trucks to in-state destinations. It delivers to warehouses, residential properties and businesses.

Molina got his start in transportation running Circuit City distribution centers. When the economy tanked for the retailer in 2008, “I got a call from a former home-delivery manager at Circuit City” who’d moved on to the Crate & Barrel operation in need of third-party capacity.

Molina bought a 26-foot box truck, hired a good driver he knew and went to work doing home delivery for Crate & Barrel. The business has prospered, particularly within the last year as he’s dedicated three of his company’s units to Cargomatic’s on-demand brokerage platform for local trucking.

Company cofounder Brett Parker says Cargomatic works for local truckers in several key ways. The technology speeds up a lot of the transactional elements of dispatch, load search and selection, rate confirmation, proof of delivery and payment. These were once the province of time-consuming phone calls and shuffling of paper in the back office and the cab. This is much like what Uber does for its drivers, or what smartphone apps from brokers, carriers and load boards do in some ways for truckload haulers.

“We want to work with the independents in the local market to give them opportunities with the bigger shippers,” Parker says. That can mean moving high volumes of freight from warehouse to warehouse or direct to the consumer.

They’re working with “forwarders, brokers, the 3PL warehouse, the retailer [and] the carriers themselves,” Parker says. As the company has inked agreements with more such entities, broadcasting availability and truck location via the Cargomatic smartphone app has led to new opportunities for Molina and California LTL.

Suppose one of his trucks on the road has capacity for two empty pallets. “Cargomatic knows that,” and entities with freight in the system have the ability to see it. “They know where my driver is, they know what capacity he has left,” and if a load that fits weight/size parameters is in the driver’s lane, “worst case, they give him a call to do it. Otherwise, it’s automating dispatch.”

We’re seeing a growing trend in carriers running brokerages,” Blair says. “And that trend of feeling compelled to run a brokerage to move freight is moving down-market. Smaller and smaller carriers are doing it. Used to be you’d have above 200 trucks if you’re doing that. Today, we’re seeing it move into the 15-20-truck range.”

It’s hard to spend a lot of time marketing as a small fleet, Parker says. “We want to be able to do that for them.”

The company recently announced $8 million in venture capital funding, including from some prominent trucking players. Parker says it’s going to market soon in and around New York City, and then in major cities such as Atlanta and Chicago.

In truckload, new players like DashHaul and Keychain Logistics are operating as automated brokerages, seeking ultimately to connect independent owner-operators and small fleets operating in the spot market directly to shippers through mobile-enabled platforms. Others, like the Trucker Path startup, hope to do the same, but not as a brokerage. Companies like Truckstop.com and DAT, meanwhile, are enhancing their transportation-management-software integration features to enable carriers that broker freight a more direct connect to spot market capacity, addressing pain points in today’s tight driver market.

More and more, says DAT General Manager Steve Blair, carriers unable for a variety of reasons to bring on drivers are moving to broker loads to provide customers service. “We’re seeing a growing trend in carriers running brokerages,” Blair says. “And that trend of feeling compelled to run a brokerage to move freight is moving down-market. Smaller and smaller carriers are doing it. Used to be you’d have above 200 trucks if you’re doing that. Today, we’re seeing it move into the 15-20-truck range.”

The company’s DAT Keypoint TMS software is seeing “growing success in addressing that need,” Blair adds. “Carrier [TMS] software is not as efficient and don’t provide all the necessary tools for a true brokerage operation.” As smaller and smaller fleets look at brokerage, Keypoint is seeing more and more interest as a way to post and track freight, integrate into mileage systems and more. “It gives the appearance of a large, technically capable broker on a low budget.”

Original Source: https://www.ccjdigital.com/freight-matching-uber-style-mobile-tech-give-rise-to-streamlined-freight-transactions/