Truckstop.com’s Perry (left) and Hutto debut the load board operator’s spot-market rate forecasting service, which the company launched last fall. (Seth Clevenger/Transport Topics)

Load boards have changed a lot from their humble beginnings about 40 years ago. Long gone are written notes tacked up on truck stop bulletin boards to help drivers find freight, or using telephones at truck stop restaurant tables and paying expensive long-distance rates to get loads lined up.

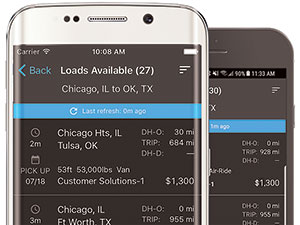

These days, there’s instant information about loads or available trucks delivered to any computer or mobile device. At the same time, the depth of the information is greater than ever before as these freight exchanges evolve into providers of spot-market data analytics — and the level of information is expected to keep growing.

“It’s now more of a digital marketplace of trucks and brokers, and we’re trying to build our solution so that companies can be automated to connect the freight with the capacity that’s out there,” said Don Thornton, senior vice president of sales and marketing at DAT.

Load board operators such as Truckstop.com offer rate analysis and other data-driven services. (Truckstop.com)

That’s a big advancement from when the company started out in 1978 as Dial-A-Truck. Since that time it has grown from a small operation serving a handful of brokers and carriers in the Pacific Northwest to covering the full United States and Canada, with about $45 billion in freight spending annually.

Along with its nearest competitor, Truckstop.com, which began in 1995 as Internet Truckstop, the first freight-matching marketplace on the Web, the two have at least an 85% share of the load board marketplace, with DAT having the largest slice of the pie.

Like DAT, Truckstop.com is increasingly focusing on analytics, said Noël Perry, Truckstop.com’s chief economist. He described the company as a collector and provider of big data.

“If you go back 15 years, the only way to get loads would be to call the brokers that you had a relationship with,” Perry said.

While that changed with the debut of computerized load boards, “the difference between five years ago and now is twofold,” he said. “The tools are slicker and have been refined. Also, there are more people involved and there are more information bits that are available for each load.”

According to Brent Hutto, chief relationship officer at Truckstop.com, both companies offer many of the same services to shippers, carriers and brokers, such as information on loads, rates and insurance, just to name a few.

“The ‘why’ of this is due to the explosion of data that can be gathered on customers and industry suppliers and being able to express that in a form that all companies can use,” he said.

For example, Mode Transportation, an agent-based and nonasset division of Hub Group, works with both DAT and Truckstop.com and gets nearly a third of its truckload business from the spot market, said Brad Young, Mode’s vice president of network solutions and services.

Carriers can access the DAT TruckersEdge load board through a mobile app. (DAT Solutions)

“By making the data actionable, we are looking to provide insight into things like, what is the current spot market pricing in a given market or lane, how it is trending, what carriers are currently searching for freight or posting their equipment, who has searched or posted in the past, what does the origin/destination market look like in terms of finding that piece of equipment, and other points,” he explained.

Young said Mode also has large amounts of internal data that go into its decision-making. That information, overlaid with what it receives in external data such as from DAT and Truckstop.com, enables the company to be better prepared to cover customers’ freight in today’s challenging market.

“The beginning of 2018 has shown that this year will be very challenging in terms of available capacity,” he said. “If we can provide for our dispatchers any type of knowledge or insight that can give them a leg up in their daily pursuit of capacity, then we are that much more ahead in the race.”

While the spot market and data about it have grown exponentially over the past decade, the providers aren’t stopping there.

Last fall, Truckstop.com, in partnership with the transportation research firm FTR, introduced its rate forecasting tool. Billed as an industry first, it offers lane-by-lane forecasts, projecting spot market rates up to 52 weeks out.

It uses and analyzes 10 years of paid rate data from Truckstop.com’s marketplace in addition to FTR’s propriety economic modeling algorithm that measures 13 million data points each month. The result, according to Truckstop.com, is a forecast showing the different trends on each of 160,000 freight lanes and 6 million origin/destination pairs.

According to Hutto, this information can benefit brokers, carriers and shippers by helping them in their budgeting as well as benchmarking and business planning.

If we can provide for our dispatchers any type of knowledge or insight that can give them a leg up in their daily pursuit of capacity, then we are that much more ahead in the race.

Brad Young, Mode

DAT has taken a different approach when it comes to the future of the spot market and data analytics.

In late October, the company announced it entered into an agreement with the companies TransRisk, a data intelligence and financial products service company for the freight industry, and Nodal Exchange, a derivatives exchange currently serving the energy market.

The companies are working together to market, develop and list the first trucking freight futures and options on futures contracts, set to go live late this year, which will be financially settled using DAT’s truckload rate index.

Thornton said DAT doesn’t offer rate forecasting — at least not yet.

But certain customers already are relying on past DAT data in their own way. One of them is Transplace, a transportation management and logistics services provider.

According to Ben Cubitt, senior vice president of supply chain and transportation at Transplace, the company uses DAT data in multiple ways, including to price daily spot volume in its capacity service teams, and to identify historical rates and capacity in key markets.

“Transplace uses DAT data to optimize individual shipments but also uses larger data sets [such as] multiyear history for an origin market or lane, network or regional data for a week, month or year, to identify and document trends over time,” he said.

While it may be unclear exactly how data analytics will evolve in the years ahead, DAT’s Thornton said he is confident that it will make for more efficient marketplace.

“The brokerage model does a great job of matching capacity with freight. I think it will continue to be a successful business model and they’re going to get more automated,” he said. “And DAT is going to help with our solution so our customers get more automated. The tool will help you connect with those carriers and it will be more seamless.”

With an upcoming freight futures market relying on DAT’s take on spot market prices to determine how much contracts are settled for and Truckstop.com offering forecasts on what spot market rates will be up to a year from now, there is no doubt the race is on when it comes to improving data analytics from freight exchanges.

However, one questions remains. Just how accurate will all of this data be? That can possibly be summed up by Truckstop.com’s Perry.

“Every forecast, every piece of analysis is going to be wrong in one way or the other,” he said. “If you have a good supplier of analytics, you’re going to be less wrong [than] the next guy.” ³

Original Source: https://www.ttnews.com/articles/load-boards-evolve