Spot rates still depressed as businesses begin to reopen, DAT Solutions says.

Truckload freight volumes “bottomed out” at the beginning of May, but have since recovered to pre-pandemic levels and largely returned to seasonal patterns in the second half of the month, according to an analysis by the online freight marketplace operator DAT Solutions LLC.

The Portland, Oregon-based firm said its DAT Truckload Volume Index, a measure of dry van, refrigerated (“reefer”), and flatbed loads moved by truckload carriers, rose 0.6% from last month but was off 8% as of May 2019.

“As businesses begin to reopen across the country and produce season ramps up, we’re seeing a trend back to pre-Covid levels, consistent with seasonal market dynamics,” Ken Adamo, chief of analytics at DAT, said in a release. “There’s also increased demand at major ports and signs that June will be a strong month for freight.”

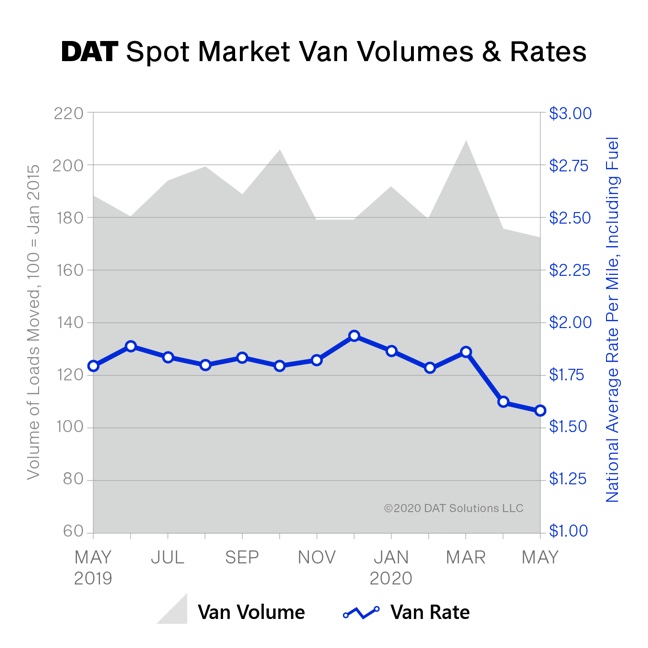

Nationally, the May load-to-truck ratio for vans nearly doubled to 1.9 compared to last month and was up slightly from this time last year as well, indicative of a market with more freight than trucks posted on the DAT network. The spot van rates averaged $1.58 per mile nationally, down 4 cents compared to April and 21 cents versus May 2019.

“There was a deep hole to climb out of due to the economic downturn, but we’re seeing the market stabilize,” Adamo said in the release. “The economic engine of the country restarted and picked up momentum towards the second half of May and into June.”

The analysis ran counter to a forecast today from the Port of Virginia that said its statistics for inbound and outbound containers had dropped sharply in May and could remain depressed through August. But that assessment was focused on global imports, as opposed to domestic road freight.

Original Source: https://www.dcvelocity.com/articles/46301-truckload-freight-volumes-recovered-to-pre-covid-levels-at-end-of-may