Article written by James Jaillett

As the number of ELD vendors narrows, some industry observers and owner-operators wonder if FMCSA’s registry of self-certified electronic logging devices can remain current and accurate. Those questions are explored in the second part of this series at this link.

By the end of August, independent owner-operator Alipio Montano will be on his fourth electronic logging device provider in a little over two years.

Montano, who runs two-truck CDR Transportation Services out of Houston, Texas, opted for the One20 F-ELD before earnest enforcement of the U.S. DOT’s ELD mandate began in April 2018. Marketed as a device for owner-operators, the F-ELD was an outshoot of the now-defunct TruckThat app. But just months after the mandate took effect, One20 abruptly announced it was discontinuing service, giving Montano just 30 days to find a new provider.

He switched to the popular KeepTruckin for roughly a year. Then at the beginning of this year he invested nearly $2,000 to outfit both of his trucks with Continental’s VDO Roadlog system — long billed as an owner-operator-focused system and the only product with a built-in log printer.

Montano has been on VDO since February, but VDO announced in April that it too is discontinuing service in August, leaving Montano once again searching for a new ELD provider.

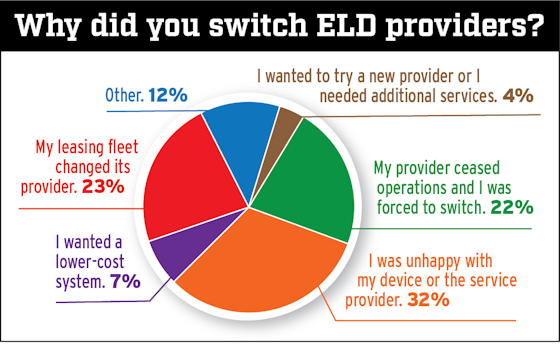

Of the more than 1,100 owner-operators surveyed by Overdrive in May and June, 24% (264) said they had switched providers at least once since the ELD mandate took effect in December 2017. The chart above details their reasons for that transition. Of note, 22% said it was because their provider ceased operations, and 32% said it was because they were unhappy with their device or service.

“It not only costs a lot of time, it costs a lot of money,” he said, to switch providers. “It’s a big hassle. And then if I switch to another provider, is it going to be the same story again – ‘We’re closing’?” he said.

He cited issues with log data retrieval and questions in compliance audits, should they arise, as key concerns in changing providers. Not to mention the lost investment. “I bought everything up front — the subscription, the wires, the harness, the fleet card,” since he employs a driver.

Many other operators have faced similar problems of cost, inconvenience and uncertainty as they’re forced to quickly switch ELD providers. That fate also appears to await other owner-operators and small fleets, too.

After the Federal Motor Carrier Safety Administration announced the ELD mandate in December 2015, new providers flooded the market as the mandate’s initial effective date of December 2017 approached. Now, with more than 400 device providers and 500 devices listed in the U.S. DOT’s ELD registry, and self-certified as compliant with mandate specs by ELD vendors, observers say the market’s headed for consolidation. That could mean mergers and acquisitions or ELD vendors simply throwing in the towel, perhaps with little warning.

“The market simply cannot support 400 vendors,” said David Lady, founder of ELD maker GeoSpace Labs. Anticipating an ELD market shake-out has been part of GeoSpace’s long-term business strategy, he said, and they’ve tried to carve out a dedicated niche with a good product for the company’s focus on agriculture and other specialized operations. He’s declined multiple acquisition offers from other companies looking to buy.

CDR Transportation Services owner Alipio Montano invested $2,000 in early 2020 to equip his 2007 Freightliner Classic and his 2012 Peterbilt 389 with this Continental VDO Roadlog device. Two months later, Continental announced it was ending its service — the second time his ELD maker abruptly forced him to find a new ELD provider.

Beyond the market’s oversupply of vendors, two other factors are driving what could be a dramatic decline in the number of available ELD options in the near future. One is the pandemic-driven economic downturn. The other is the need for ELD providers to update their software for FMCSA’s new hours of service rule, which takes effect Sept. 29.

“There are a lot of small players who could not get traction,” says Tapan Chaudhari, founder and CEO of ELD provider TruckX. “Vendors who have maybe 200 to 300 trucks and that’s it. It’s very hard for them to maintain service. All of these vendors will go down.”

Smaller providers, however, aren’t the only ones closing. In addition to One-20’s F-ELD and Continental’s VDO Roadlog, the Cummins-backed ZED Connect in January 2019 announced its departure from the ELD marketplace. That device was also geared toward owner-operators and small fleets. Likewise, ELD makers Samsara and KeepTruckin this year announced workforce cutbacks. That was early on in the the COVID-19-wrought economic downturn for the latter, and a sign that even with good market share – KeepTruckin’s ELD is used by 19% of owner-operators and small fleets recently surveyed by Overdrive – some vendors are finding it tougher to navigate the ELD market.

The trend toward a tighter market likely means a clearing out of some of the lowest-tier ELD options on the market, those with little in the way of customer support and suspect hardware and software, and potentially some of the cheapest options, though nailing down price ranges among market tiers is difficult, given the myriad of different price structures across the hundreds of devices.

Of more than 1,100 owner-operators surveyed by Overdrive in May and June, 24% have switched ELD providers at least once since December 2017, and 20% of those said it was because their ELD provider ceased operations. Nearly a quarter of respondents said they’d likely switch providers in the coming year, with a third of those saying it’s because they anticipate their e-log vendor to close shop. Of those who have changed providers, 32% said it was because they were unhappy with their device or their provider.

Geospace’s David Lady foresees the market settling to about 30 device providers. TruckX’s Chaudhari, however, sees a dwindling to as few as 10 providers within the small- and medium-fleet segment. Enterprise vendors like Omnitracs and Trimble, Chaudhari contends, will continue to mostly own the larger fleet market.

“It’s already happening, and I think it’s only going to accelerate over the next year,” said Ken Evans, founder and CEO of Konexial, of consolidation among ELD providers. Konexial’s My20 suite of products is anchored by the company’s ELD app.

Device providers that have focused on creating reliable products and that offer good customer service have been able to distinguish themselves, said Evans, particularly as owner-operators have become more knowledgeable buyers. Providing services or discounts beyond basic logging, such as calculating IFTA or offering fuel savings, also helps set ELD makers apart. Lastly, he said, ELD providers who are able to stay lean have a better path toward long-term viability.

Missouri-based independent and step deck hauler Kevin Gray was a user of the One20 F-ELD in 2018 when the company announced its sudden demise. “They gave us 30 days to get a different ELD. They just closed, and they didn’t give me any of my data,” he said. “At the time, ELDs being so new, it didn’t register with me that if I would have been audited, I didn’t have any of my information backed up to give to FMCSA.” He’s had his 2012 Freightliner Cascadia equipped with a KeepTruckin ELD since.

One key culprit in driving the number of self-certified devices in FMCSA’s registry so high is so-called “white-labeled” devices and/or software, said Mike Ahart, vice president of regulatory affairs at Omnitracs. “One ELD code-writer writes the code and then multiple resellers list it or label it as their own product,” he said. Those “resellers” may also use the same hardware supplier for the device that hooks to the electronic control module. Ahart estimates there could be as many as 100 devices that effectively run the same code and the same hardware.

“A lot of people saw an opportunity to jump in and make a quick buck,” said Jack Spangler, partner manager at KeepTruckin. Those quick-buck devices failed to keep up, both with the pace of ELD technology changes and in building out features.

Device makers that don’t make it a point to continually invest in their products could pose security concerns, said Scott Sutarik, vice president of commercial vehicle solutions at telematics provider Geotab, which has large presence in the mid-sized to larger-fleet market. “Meeting the ELD mandate is not trivial. There’s a lot of engineering that goes into it, the need for a lot of back-end changes. And from a security standpoint, is the software secure? Is the transmission of data secure? You need to have technical support and invest in device and firmware costs to improve or just to keep running.”

Some owner-operators, scornful of the mandate, initially flocked to devices marketed as quick, cheap compliance options. “They didn’t do their homework and didn’t look or choose wisely,” says John Hruska, second-generation owner of John Haruska Trucking and Diesel Transport, a 30-truck tank-hauling fleet out of Windeer, Pennsylvania.

“What they got was a pile of junk,” he said, and they were stuck with the devices for a contract lasting six months or longer. “They wouldn’t work. They wouldn’t connect.” Now, operators are doing more research before buying, he said.

Hruska equipped his fleet with VDO Roadlog. After their closure was announced, he opted for Maven Machines. He liked the simple user interface and the customer support. Also, he pressed them on their ability to operate long-term. “Those were some of my first questions,” he said.

In most cases of ELD providers shuttering services so far, as with the VDO Roadlog or One20’s F-ELD, there was no merger or purchase by another company. Other providers jumped in to offer discounts, such as 50% off hardware costs and a service discount for six months or a year, for those left stranded.

As consolidation continues, though, some observers believe there will be more merger and acquisition activity as smaller vendors close, which would tend to cause fewer headaches for small operators who are customers of those smaller vendors.

Largely because of the economic downturn brought by COVID-19, Geotab’s Sutarik foresees the coming consolidation as not limited to large providers gobbling up small ones. “I could see players that are very large right now having significantly smaller footprints or not being around at all,” he said. “I can envision some of the smaller guys becoming major players.”

Original Source: https://www.overdriveonline.com/eld-market-consolidation-owner-operators/